AOT – ADR Option Trading #SWI2004

Problem

The problem AOT presents is that of ADR-option pricing. In the brief outline below the problem and its setting are described. In the final presentation of the problem, a brief introduction to options and option pricing will be given, such that the jargon will be clear.

ADRs

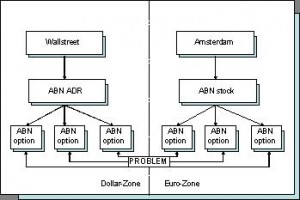

As a stock and derivative trading firm, AOT is active on several exchanges over the world. One of the strategies trading is based on, is the so-called ADR trading. ADR is an acronym for American Depository Receipt and is tradable on a US exchange that is based on foreign stock. Consider for example the stock ABN-AMRO, traded at Euronext Amsterdam. A U.S. bank bought a bunch of these stocks, put these into its safe, and printed some U.S. notes that can be exchanged for the stocks. These notes are traded on the NYSE and called ABN-AMRO-ADRs. As these ADRs are equivalent to the ABN-AMRO stock, their price should be the price of the Euronext listing converted into Dollars.

Options on ADRs

As the ADRs are traded assets on an exchange, they can be used to construct derivatives. On a lot of ADR-counterparts of Dutch Euronext stocks options can be written or bought. ADR-Option trading consists of trading these U.S. options against the Dutch ones, and the hedging should – where possible – be done with Dutch stocks (this reduces trading fees).

Pricing Problem

Before trading these options, we need a price for them. Pricing the U.S. options comes at this moment down to correlation estimation between the Dutch stock and the Euro/Dollar exchange rate, where we assume that both processes can be modeled by the standard GBM with correlated Brownian Motions. In the past, this did not work well at all. Correlations are not stable, but heavily changing and even when they were stable the P/L did not match the expected P/L. Furthermore, it is not clear at all how the correlation will translate Dutch skew into U.S. skew.